Digital Money | The Permission to Participate, No-Escape Economy | A Tool Of Behaviour Control

GlobalResearch.ca | Mark Keenan

For generations, money was something people held in their hands — a tangible symbol of work, value, and exchange. Today, money is becoming something else entirely: a digital leash. The transformation is happening quietly, without consent, and most people will not recognize what has been built until the gate locks behind them.

A new financial order is emerging — one where central banks, not markets, determine who can participate in the economy. It is a system that promises security and stability, while constructing the most sophisticated control mechanism in human history.

This is the no-escape economy, and its architecture rests on three pillars: debt, digital money, and total surveillance.

Debt: The Original Chain

Debt used to be a tool. Today it is a cage.

Nations no longer tax their populations before spending — they borrow from private central banks. Corporations do not save capital to expand — they leverage borrowing. Families do not save for homes or cars — they finance everything on credit. Debt is no longer an exception in the economy; it is the foundation.

Once a society becomes dependent on debt, freedom becomes conditional. Governments rely on central banks to survive. Corporations rely on lenders. Individuals rely on credit. And whoever controls the debt controls the debtor.

A debtor society cannot say no. It can only comply.

When Money Becomes Software

The next stage of control is already underway: the elimination of cash.

Cash is inconvenient for central planners. It is private. It does not require permission. It cannot be monitored, frozen, or reversed. So cash is being removed — not by banning it, but by making it irrelevant. ATM networks shrink. Bank branches close. Stores become “cashless for convenience.” Increasingly, money exists only as digital data inside the banking system.

But digital money is not money. It is permission to participate.

Electronic payments pass through private gatekeepers: banks, payment processors, and soon, central banks themselves. If those gatekeepers disapprove of what you buy, what you donate to, or what you believe, access can be denied instantly.

This is not hypothetical. Visa and Mastercard blocked donations to WikiLeaks without any court ruling. PayPal has repeatedly closed accounts of journalists, writers, and activists and held their funds for months. GoFundMe froze millions of dollars for the Canadian truckers and announced plans to redistribute the money until public pressure forced a reversal.

When money becomes digital, you do not own it. You rent access to it.

The Digital Currency Trap

Now comes the final piece: Central Bank Digital Currencies (CBDCs).

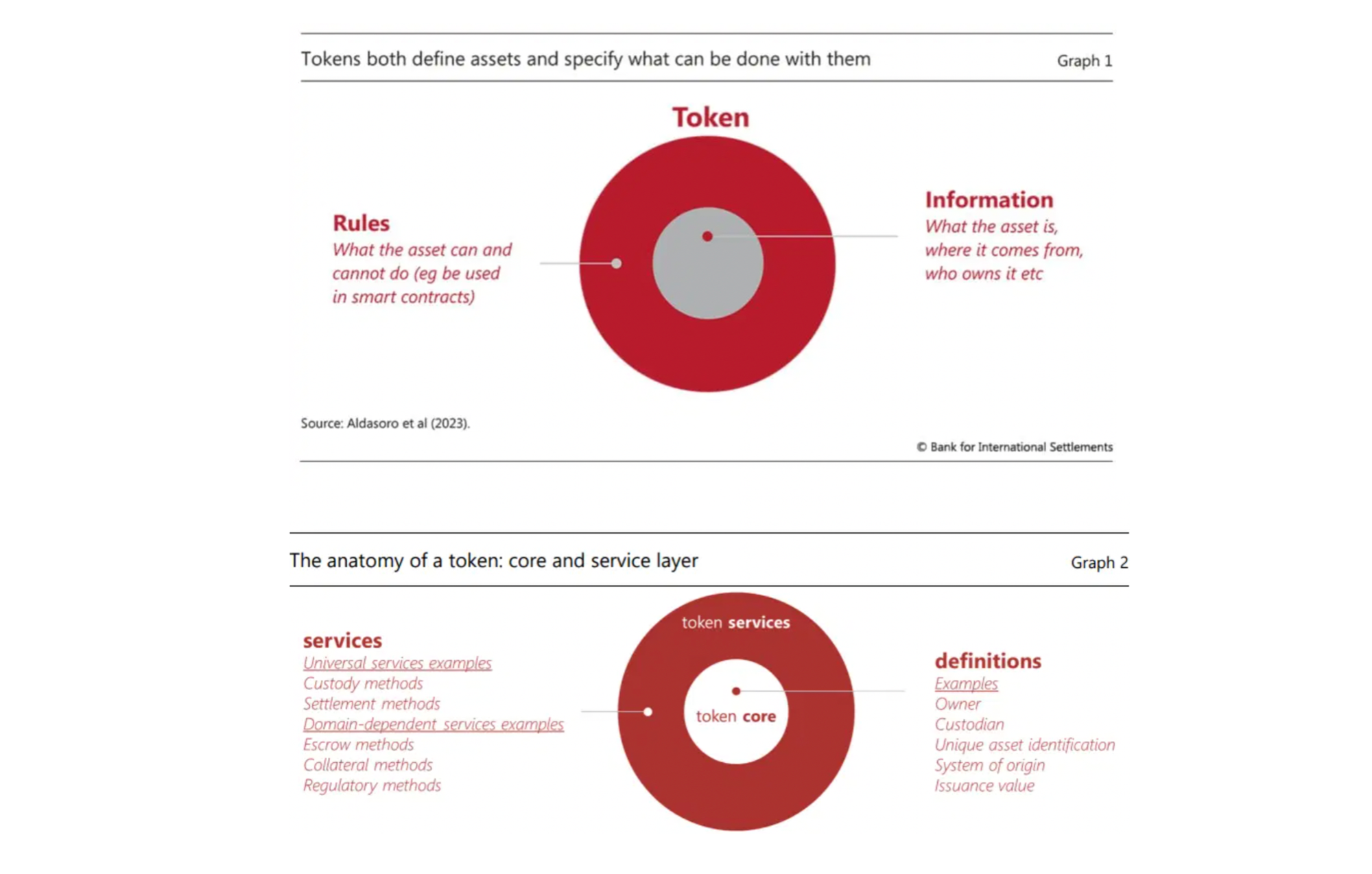

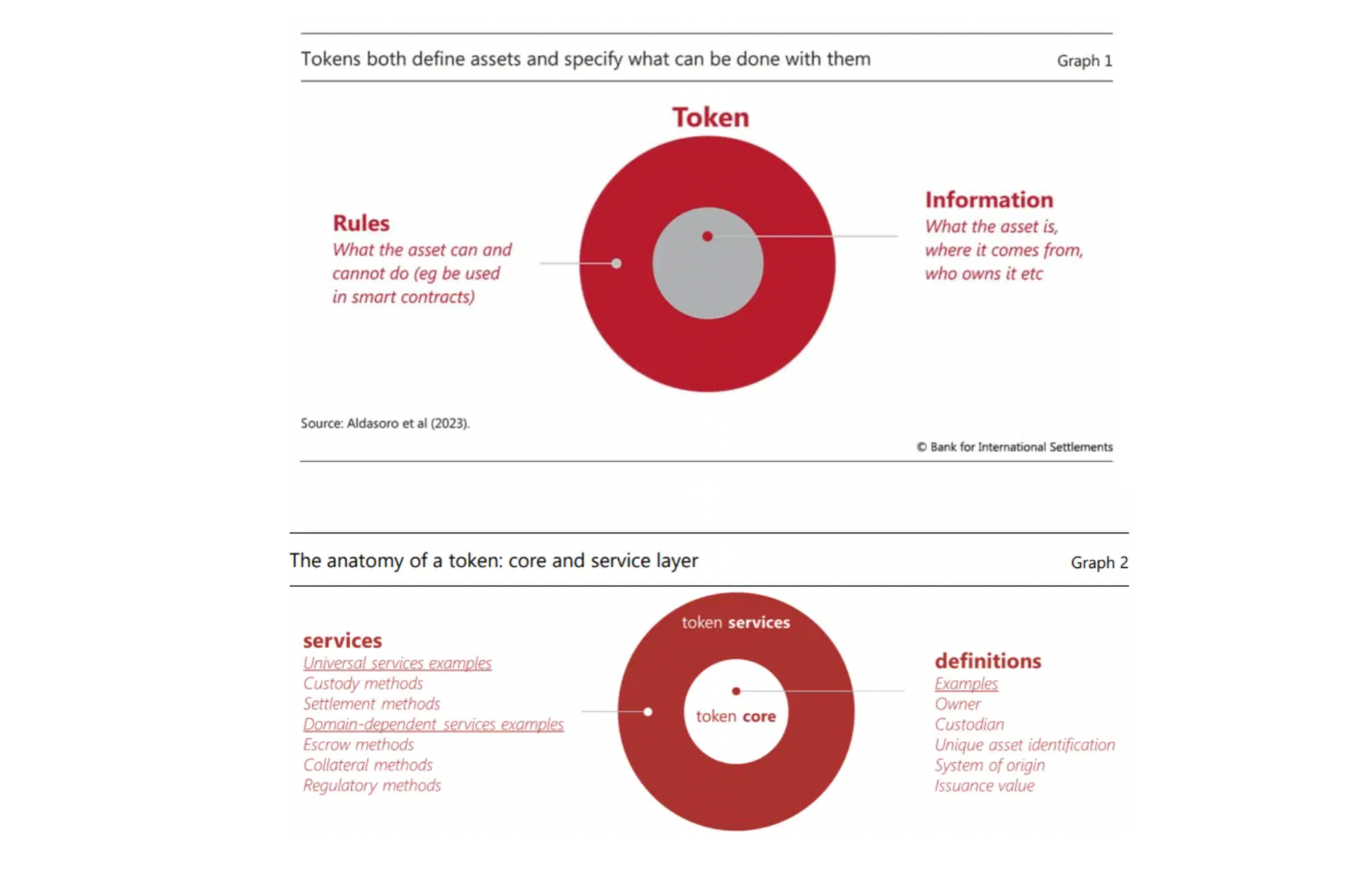

CBDCs are sold as modernization — safer, faster, more inclusive. But the design reveals something else entirely:

Money that can be programmed.

Money that can be traced.

Money that can be frozen.

Money that can be selectively turned on or off.

A CBDC can be set to expire after a deadline. It can be restricted to certain locations. It can be blocked from purchasing certain goods. It can lock itself during an “emergency.” It can shrink in value if a citizen disobeys.

In a CBDC system, money is no longer a store of value. It becomes a tool of behavioural control.

This is not a theory. The Bank for International Settlements — the central bank of central banks — openly states its intention to embed “programmable money” and “programmable payments” into CBDCs. Nearly every Western central bank is running pilot programs. Once introduced, CBDCs will not just replace cash; they will replace freedom.

Debt Was the Setup. CBDCs Are the Lock

Debt made the public dependent on central banks. CBDCs will make the public dependent on obedience.

Government overspends — central bank prints — inflation rises — digital currency is introduced as the “solution.” The crisis becomes the excuse for the control system that was planned in advance. As I explored in my book The Debt Machine: How Private Banks Engineered Global Control, inflation is not an accident of policy — it is a mechanism of control. Each crisis transfers more power from governments to the banking institutions that create money from nothing.

The IMF, the UN, and the World Economic Forum all say the same thing: the future economy will be cashless, centralized, and programmable.

When money requires permission, freedom becomes an illusion.

Total Surveillance Disguised as Safety

CBDCs will be sold as protection against fraud, terrorism, and money laundering. But the real purpose is surveillance.

In a CBDC regime, every purchase is recorded, every donor is identified, every transfer can be blocked, and every account can be frozen. Not by law. By software.

You do not need police to enforce compliance in a digital economy. The banking system becomes the police.

What Happens to Dissent?

In the old world, silencing someone required effort: laws, courts, arrests, media justification. In the new world, silencing someone takes a keystroke.

Accounts closed. Payments blocked. Access denied.

No trial. No explanation. No headline.

Ask the Canadian truckers. [and some Canadians who had their accounts frozen for donating to them]

Ask the journalists de-banked in the UK.

Ask the activists whose PayPal accounts disappeared.

This is not the future. It is the present.

Why Cash, Gold, Bitcoin, and Local Trade Terrify Central Planners

Three forms of money threaten this system:

Cash — anonymous and untraceable.

Gold — value outside the banking system.

Open blockchains like Bitcoin — permissionless, censorship-resistant, and outside centralized control. [Currently] While not literally “untouchable,” it appears no single government or corporation can alter the Bitcoin ledger on its own. [however this may not last as anything linked to computers can be affected by software]

In India, over 85% of high-value banknotes were removed from circulation overnight in 2016, after the government abruptly invalidated most currency in a surprise “demonetisation” policy. In Nigeria, the central bank imposed strict cash-withdrawal limits — as low as 20,000 naira per week [$14 USD]— as part of a push to force adoption of its digital currency. The EU is moving to ban cash transactions over a few thousand euros. Governments constantly attempt to regulate, tax, or outlaw self-custody of Bitcoin, not because of crime, but because it is outside their control.

If money is freedom, then controlled money is controlled freedom.

What Comes Next

The no-escape economy will not arrive suddenly. It will arrive gradually, quietly, and logically. It will be sold as convenience, efficiency, sustainability, safety, and progress.

And most people will accept it, not because they want tyranny, but because they never understood what they were trading away.

How to Resist

The defense is not political. It is practical.

Use cash.

Hold gold and silver outside banks.

Use permissionless digital currency where possible.

Build local trade networks.

Support parallel economies (cash, local exchange, time-banks, community markets).

Store value outside the system.

Freedom will not be saved by elections. It will be saved by stepping outside the system.

When enough people stop asking permission, the system loses power.

There is a deeper dimension to this struggle — not just monetary, but legal and spiritual. Long before digital IDs and CBDCs, the system claimed ownership of identity itself. That subject is larger than this article can hold, but I explore it in depth in Demonic Economics and future essays.

The Final Question

If the government can turn off your money, are you free?

If banks decide who can speak, is there free speech?

If transactions require political approval, is it still a market?

Once CBDCs replace cash, there is no going back. The gate will close, not with a law, but with a software update.

This is the future being built now. We either recognize it — or we will wake up inside it.

Source: https://www.globalresearch.ca/central-banks-building-no-escape-economy/5905361

Original Article: https://www.globalresearch.ca/selected-articles-central-banks-building-no-escape-economy/5905387

Related:

Donate To Support Our Work At Truth11.com

When you support independent media sites such as Truth11.com you are helping an industry survive and grow, and are directly helping people who work for you to bring you the truth.

Thank you truth warriors!

Comments ()