Social Credit Score | Bank For International Settlements (BIS) Proposes Grading Tokenized Wallets And Enforcing 'Compliance Score' Based On Transactions To Force Behavior

"Compliance scores could vary depending on the type of rules applied, ensuring the scoring system remains relevant and effective across diverse regulatory environments."

The WinePress | substack.com/@thewinepress

Social credit scores are on their way in a tokenized economy. The Bank for International Settlements (BIS), nicknamed the “central bank of central banks,” published a short paper in August that would provide scores to tokens and digital wallets, framed as a means combating anti-money laundering (AML), based on wallet holders’ transactions.

As we have covered many times here on The WinePress, tokenization is the next evolution of finance and the global economy; replacing money and ownership with digital tokens that are tracked and traced 24/7/365, that maintain a record of transactions and ownership. [Also can be turned off or restricted]

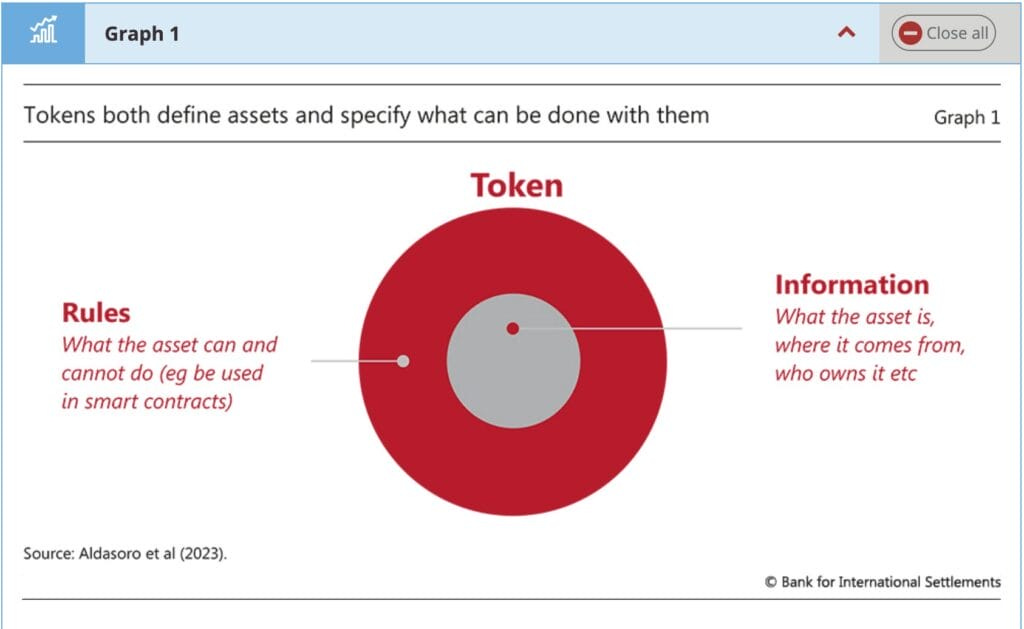

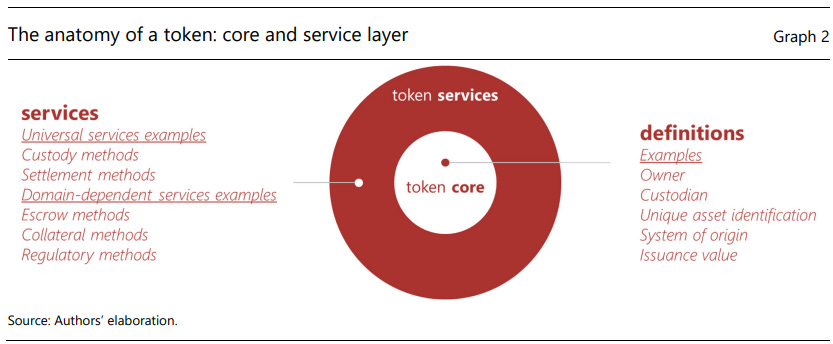

A “token,” as defined by the BIS, “are entries in a database that are recorded digitally and that can contain information and functionality within the token themselves. Digital tokens can represent financial or real assets.” A token collects information about that underlying digital money or asset: ownership, dates of purchase/sale, transaction dates, and so forth, the BIS explains.

In short, BNY Mellon, the 11th largest bank in the U.S. by assets, succinctly explains what tokenization is and broadly all things that can be tokenized:

“Tokenization of assets involves the process of digitally representing real, physical assets on distributed ledgers, or issuing traditional asset classes in tokenized form. Within the context of blockchain technology, tokenization is the process of converting something of value into a digital token that’s usable on a blockchain application and a token represents a share of ownership in the underlying asset.

“This process can work for tangible assets like gold, real estate, debt, bonds, and art, or certain forms of intangible assets such as ownership rights or content licensing. What is even more exciting is that tokenization allows for transforming ownerships such that traditionally indivisible assets can be fractionalized into token forms.”

Moreover, last month The WP partially dissected a 166-page report published by the White House called “Strengthening American Leadership in Digital Finance Technology.” The paper describes a path to tokenize the financial system in the U.S. and abroad, shifting from fiat currency to “money-like” (their words) digital dollars in the form of stablecoin tokens, and representing real-world assets (RWAs) as digital tokens on a blockchain.

The report goes on to list commercial tokens, which, for example, can provide “access to some specific good, service, or privilege, and is subject to other federal and state laws applicable to commercial transactions.” They can act as “a digital representation of traditional commercial instruments, such as warehouse receipts, documents of title, bills of lading, event tickets, memberships, and identity credentials.” The Working Group says, “Virtually any type of good, right, service, or interest can be represented as a digital asset on a blockchain or similar distributed ledger technology network.” Moreover, “Tokens may represent a range of different kinds of assets and liabilities, including commercial bank deposits;” and the process “can be viewed as a form of technology to record bank deposits.”

As previously explained, a stablecoin is effectively a privatized version of a central bank digital currency (CBDC).

Agustín Carstens, the now former General Manager of the BIS (he stepped down at the end of June of this year), gave ominous remarks in 2020 in which revealed that a CBDC would strip citizens of their financial autonomy and anonymity.

“We don’t know who’s using a $100 bill today and we don’t know who’s using a 1,000 peso bill today. The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.”

With tokenization, a “social credit score” aspect is introduced, behavioral modification.

While nowhere near fully tokenized, China infamously still has an early form of social credit score, which went fully into effect in 2020. The South China Morning Post provided a general overview of how it works:

China’s social credit system, by its wide definition, is a set of databases and initiatives that monitor and assess the trustworthiness of individuals, companies and government entities. Each entry is given a social credit score, with reward for those who have a high rating and punishments for those with low scores.

Business entities, including foreign businesses in China, are subject to a corporate credit system, tracking information such as tax payments, bank loan repayments and employment disputes.

The social credit system compiles a score for both individuals and companies after collecting, aggregating and analysing data from different sources.

For businesses, in addition to its own operations, companies are asked to submit information on their partners and suppliers to local and national authorities. Bad behaviour, low trustworthiness and ratings from suppliers and customers will also influence a company’s own credit score.

A good rating will lead to rewards, while a poor rating could see an individual or a company punished or sanctioned.

Individuals who are deemed untrustworthy could face a number of restrictions affecting areas including loans, travelling by air and rail as well as education.

The aim of the system is to improve transparency for the public, although it also serves as a tool for the government to impose control on almost all aspects of its citizens’ lives.

Tainted Tokens

In August, the BIS published a paper that introduces a new wrinkle to tokenization that had seldom been explicitly discussed: a social credit score aspect. They don’t call it that, but that’s clearly what it is, or some hybrid version of it. The paper is called, “An approach to anti-money laundering compliance for cryptoassets.”

Anti-Money Laundering (AML) means: “Money laundering is the concealment of the origins of money gained from crimes, including tax evasion, human trafficking, drug trafficking, and public corruption. It also includes money being illegally routed to terrorist organizations,” says Investopedia.

When President Trump signed the GENIUS Act into law to establish a legal framework for stablecoins, the bill contained AML guidance that included all kinds of “monitoring and reporting of any suspicious transaction[s],” the capability to “block, freeze, and reject specific or impermissible transactions” that break the law and other regulations, and maintaining a customer ID program.

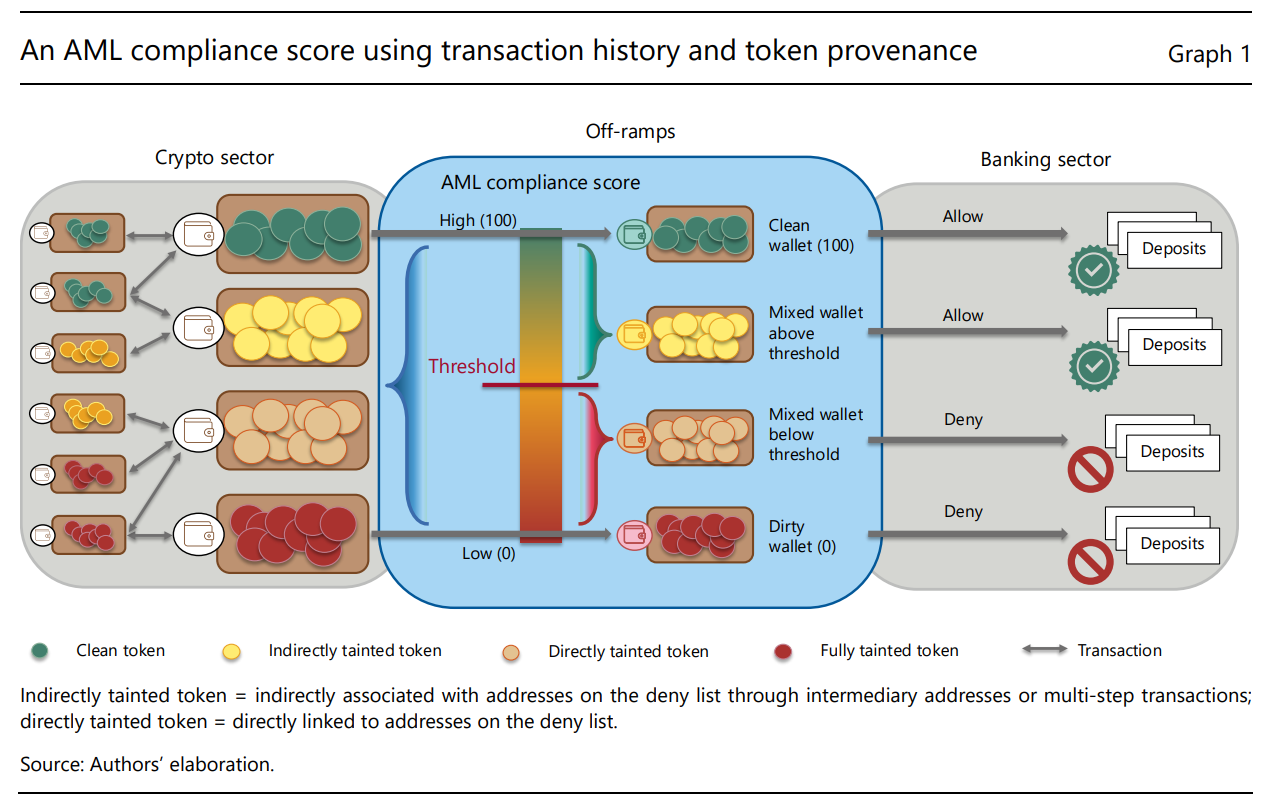

The BIS, in its paper, claims that “Existing anti-money laundering (AML) approaches relying on trusted intermediaries have limited effectiveness with decentralised record-keeping in permissionless public blockchains.” Therefore, the authors present the concept of “compliance scores” built into the tokens themselves that are linked with “illicit illegal activity” and “leveraging the provenance and history” of those tokens, cryptoassets, including stablecoins.

The authors explain how existing international AML standards simply are not sufficient for this transition into a crypto/tokenized world. Therefore, they propose:

“A diagnostic “AML compliance score” could be referenced in any further interventions by authorities when cryptoassets (including stablecoins) are presented for conversion to fiat currency at the “off-ramps” – notably, at the point of contact with the banking system.”

In the case of stablecoins, the authors note that “Stablecoins follow an “account-based” token standard on programmable blockchains, which record balances as account updates. For this reason, once a unit of a stablecoin enters a wallet, it is indistinguishable from other units in that wallet.” However, “stablecoins also allow for some degree of transaction traceability, as it is possible to map the wallet addresses that have transacted previously on the public blockchain.”

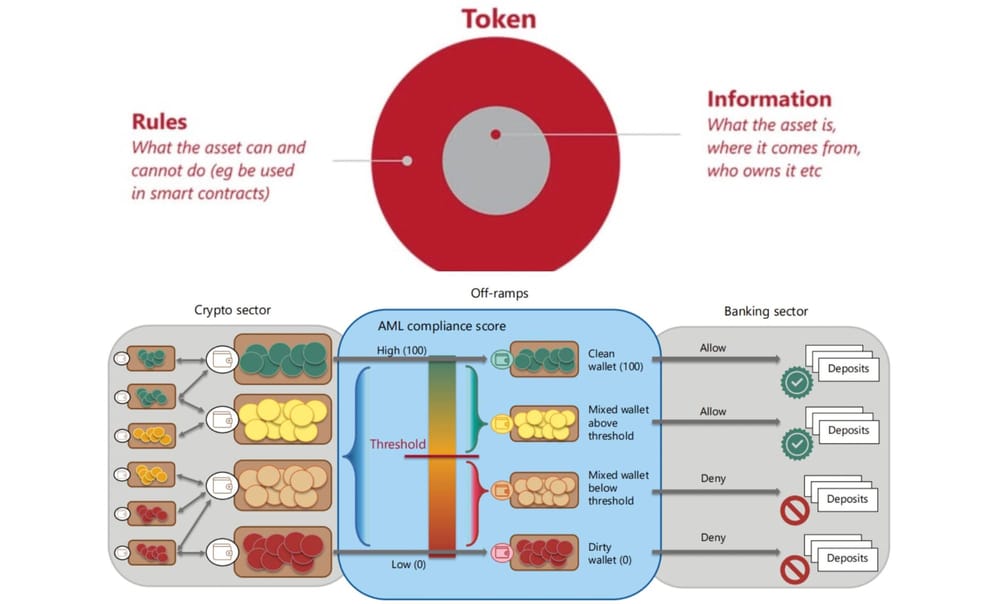

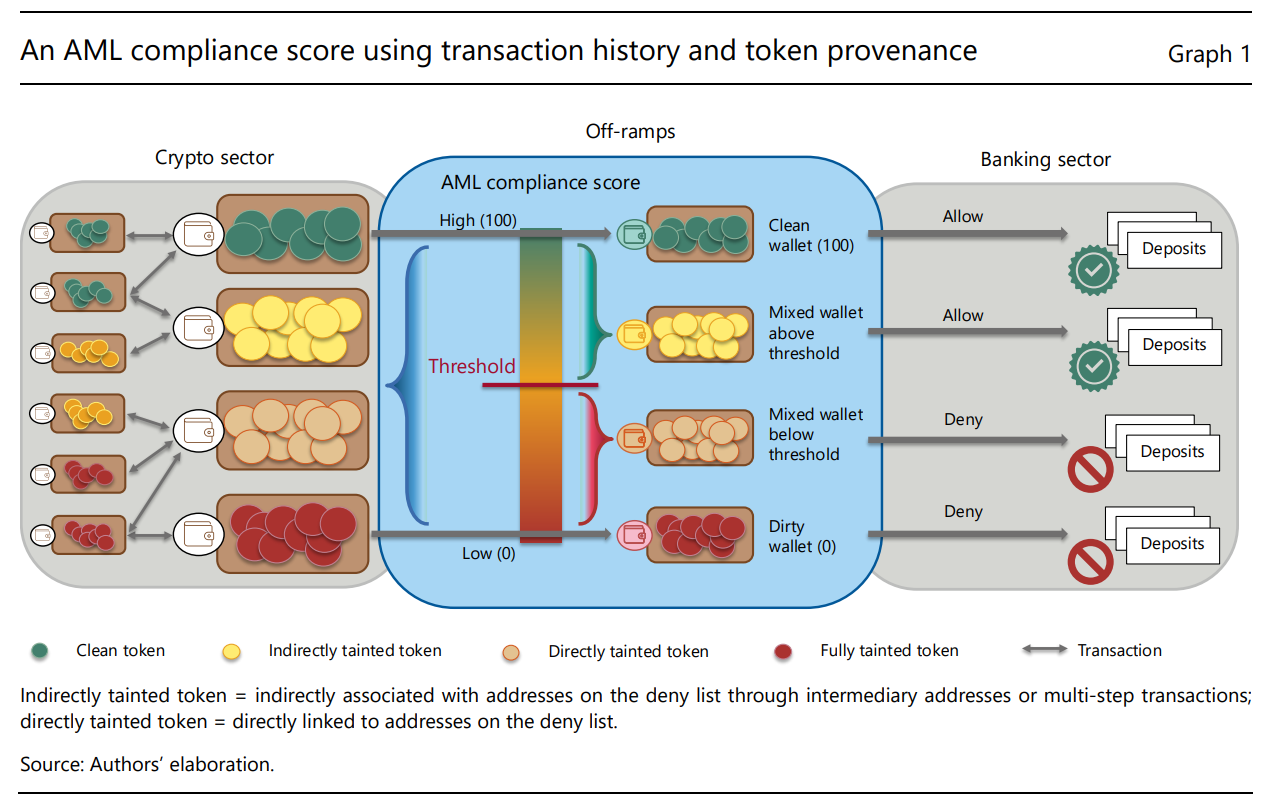

To counter this, the BIS proposes an AML Compliance Score that ranks tokens and wallets on a scale of 100 - 0 based on transaction history; ranging from what they call a “clean token” to a "fully tainted token.” The managers and issuers of these tokens can then enforce these scores based on a set of established governing rules.

The authors wrote:

The attributes of permissionless public blockchains described above suggest that a system of summary scores could be the basis of diagnostic tools and AML compliance scoring mechanisms at points of contact with the conventional monetary system. In particular, an AML compliance score that references the (unspent transaction output) UTXOs - (a term representing spare change in the form of crypto) - for bitcoins or wallets for stablecoins could use the information on the blockchain, including the full history of transactions and the wallets they have passed through. A higher value (eg maximum 100) would denote relatively clean funds, coming mostly from “allow-listed” wallets, while a lower value (eg minimum zero) would denote funds that are tainted by being associated with one or more wallets known to be on a “deny list.”

The AML compliance score for such wallets can then be assessed against a threshold value chosen by authorities following jurisdictional considerations to determine whether offramp transactions with that wallet are allowed or denied. Crypto exchanges, stablecoin issuers and banks could apply safeguards by considering minimum AML compliance score requirements for cashing out crypto coins, helping to prevent funds from illicit activities [or for any reason they want] from entering the conventional monetary system.

Importantly, AML scoring can be designed to reflect compliance with various existing rules. For example, adherence to foreign exchange regulations may be relevant for some economies. By incorporating jurisdiction-specific requirements, the scoring system can reference local rules and adapt to the specific regulatory needs of different jurisdictions. Leveraging the traceability of records, these compliance scores could further address criteria such as taxation and consumer protection. As a result, compliance scores could vary depending on the type of rules applied, ensuring the scoring system remains relevant and effective across diverse regulatory environments.

In other words, if a wallet holder uses the tokens for illicit activity, whatever that might be, depending on what the governing party mandates in collaboration with the banks and corporations that issue them, those tokens and that wallet will receive negative ratings. Every transaction will be tracked and traced, and should the holder of those allotted tokens misuse them it will cause their score to drop, eventually finding themselves blacklisted and denied access to privileges and rights.

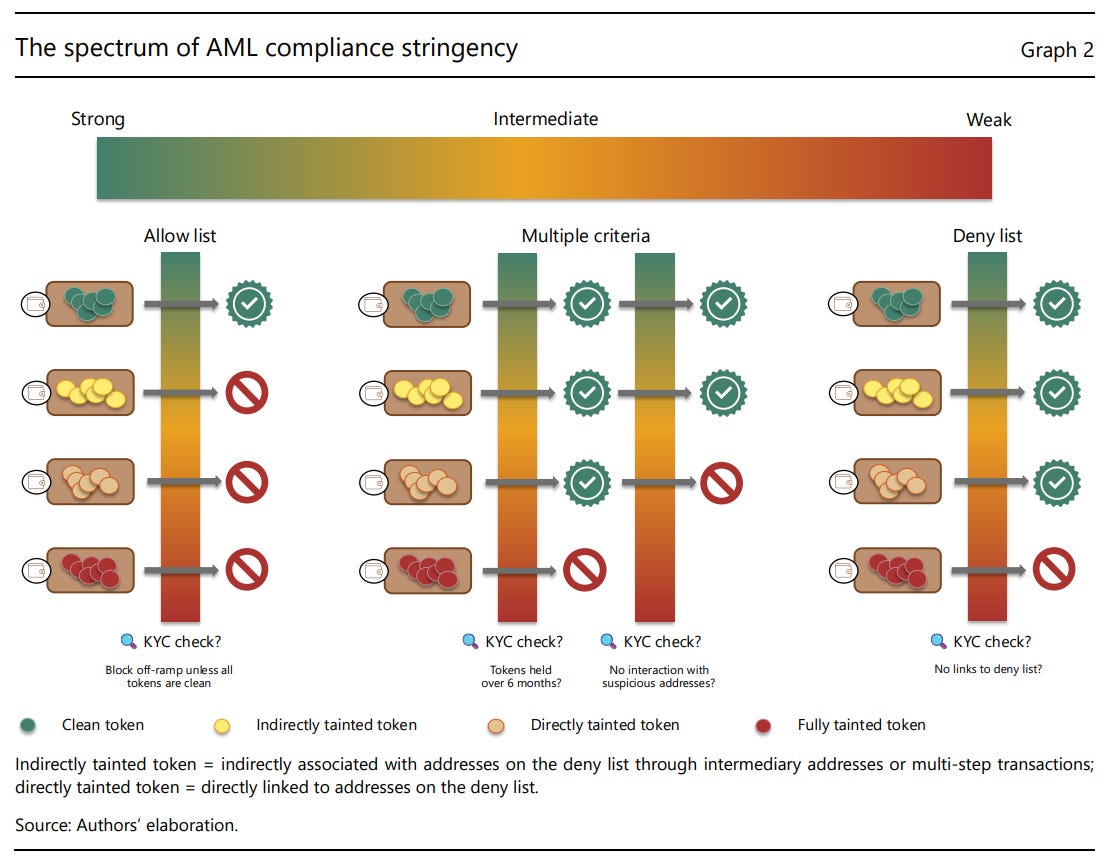

The BIS authors then go onto define how this would be enforced and the degree of stringency, which they say could “range from stringent to permissive.”

The most stringent would “require off-ramps to accept tokens for conversion only if they have passed through addresses that have met (Know Your Customer) KYC compliance checks – ie wallets that are on an “allow list.””

“Know Your Customer” (KYC) comprises your basic identity and ID numbers in current existence. But as we are currently experiencing around the world with this push to force citizens to fork over biometric data including facial and iris recognition, fingerprints, and other genetic data. On top of that, as we have discussed before, it will come to mean one’s complete transaction history - taxes, loans, credit scores, real estate, sources of funds, residency, medical records- and online search history, as the recent biometric ID check implemented by Google and YouTube is proof of this.

All of this would then be consolidated into a digital ID.

So, what the BIS is saying is that in the most “stringent” of setups the wallet holder will be forced to undergo a sweeping background check to prove who they are and what tokens they can accept. The BIS explains further:

This stringent version of the AML test implies that all users (including those operating unhosted wallets) would have to undergo KYC checks, just as all clients of banks must do when opening an account today. Using smart contract functionalities, crypto exchanges and other wallet providers could be required to block any transactions from or to addresses that are not on the allow list.

At the other end of the spectrum is a "permissive form of AML compliance is to check whether a coin has passed through an address known to be associated with illicit activity – ie on a deny list,” the BIS says. This would entail perhaps records of the “most recent recipients of a UTXO or wallet addresses are on an allow list,” that a wallet has not transacted with “deny list addresses”, or other things such as “differentiating allowable transfer amounts based on AML compliance score ranges.”

In other words, certain transactions cannot be completed if the tokens and the wallet are in the red - and this is what the BIS calls "permissive,” mind you.

But who is able to enforce such scores? Well, according to the BIS, it could be the crypto exchanges, the banks and clearing houses that convert fiat into stablecoins. On top of that, a failure to comply will result in additional penalties. Along with that, there is a general expectation that third-party entities will get involved as well.

Crucially, these approaches would require defining which actor is responsible for preventing illicit flows. This could be the individual user, the crypto intermediary (crypto exchange or virtual asset service provider) or other parties such as a system of clearing houses that convert stablecoins into fiat money. A pragmatic approach is to rely on the points where cryptoassets and stablecoins are converted into fiat currency. Imposing a duty of care on these entities would incentivise them to avoid accepting or paying out tainted coins, as failure to comply could result in fines or other penalties.

Given the public nature of blockchain transactions, more third-party service providers could also be expected to enter the market for compliance services. While some users may reasonably claim to have received a tainted token in good faith if information on illicit use is scarce, such an argument would be less persuasive if there were widespread and affordable compliance service providers.

Approaches that clearly define responsibility create incentives for good actors to seek out illicit activity and report it to authorities.

In the case of stablecoins, the BIS says “histories would enter as an essential attribute. For instance, stablecoins that had passed through wallets with a chequered history could trade at a higher discount relative to others with no such history.”

All of this brings us back to the Genius Act and how it builds off previous executive orders signed by President Trump to modernize the Treasury Department by going cashless and bringing in this new tokenized system. One of those order states:

The Secretary of the Treasury shall support agencies’ transition to digital payment methods, including by providing access through the Department of the Treasury’s centralized payment systems to:

(i) direct deposits;

(ii) debit and credit card payments;

(iii) digital wallets and real-time payment systems; and

(iv) other modern electronic payment options.

These similar stop-gap and policing measures are the same capabilities granted to banks with the Federal Reserve’s instant-transfer payment system FedNow; which was referenced in Trump’s executive order earlier this year as a tool to retrofit the Treasury Department by going cashless. Cleveland Federal Reserve President Loretta Mester explained the power banks would have with FedNow:

“It is true that FedNow and other payment services can be used to move money; however, banks have tools they could use to mitigate large outflows of deposits. For example, within FedNow they could lower their transaction limit, restrict access to the service to certain non-wholesale customers, or change to “receive payments only” status. They could also design their own controls to limit the total volume of transfers to manage their risks while serving their customers.

“Future releases of the FedNow Service may allow configurable transaction limits by customer type, if such limits are deemed useful. In addition to a bank being able to borrow from the Fed during the hours the discount window is open, a bank could use liquidity management transfers to replenish its master account balance from private funding sources on the weekend when the discount window is not accessible, which would help to mitigate the effects of deposit outflows on the health of the bank.”

The Trump administration is doing what the BIS recommends. Add in this new compliance-based score and we have a social credit score.

In conclusion, the BIS, while never actually calls this compliance score a social credit score, does acknowledge that it will force compliance and modulate “behaviors,” and therefore would incentivize to trade with “clean allow-listed wallets.”

“Compliance scores of the type described here could also generate incentives to support better outcomes in terms of overall compliance. A duty of care among users would thus be established, potentially influencing behaviour even among those transacting solely through unhosted wallets. If such duty of care took hold, there would be an incentive to transact with clean allow-listed wallets that could generate a positive feedback loop in terms of compliance.”

Finally, the BIS says: “International cooperation across jurisdictions would significantly improve regulatory outcomes.”

And there you have it: forced behavioral control, just like a social credit score.

As the World Economic Forum has infamously said: You will own nothing and be happy.

How could this be used? Well, the United Nations has endorsed using blockchain to track food with tokenization to stop “food fraud,” meaning the origin point of ingredients from the farm, to the factory, to the supply chain, to the store, to the table and refrigerator will be able to be tracked with the use of precision of AI.

Then in May, the Trump administration published the MAHA Report, which lays out how the current administration will tackle health in the U.S., and one of the solutions is “AI Surveillance.”

Imagine this in a tokenized world: ‘Eat too much meat this month? Well, that’s not “sustainable.” Leave your food in your smart refrigerator connected to your smartphone for too long, and it’s not as fresh as it was on day one? Well, that’s wasteful and we can’t have that as people starve, they’ll say; looks like we have some “tainted” and “dirty” tokens! People will comply pretty quickly once they start to see their scores and tokens disappear. Cricket burgers and Green Soylent for dinner instead.’

This is not hyperbole, this is exactly what will happen based on what these central banks are saying and doing.

It gets even worse when you consider what Trump signed in with the Genius Act, because it allows third-party corporations to effectively become a bank and issuer of stablecoins. Currently, corporations and private entities such as BlackRock, PayPal and Stripe, Walmart and Amazon, and even the Trump family have or are pursuing stablecoins. So now, they will get to set the rules and they will (in time) be able to enforce these AML Compliance Scores as the BIS describes them!

That’s why when I wrote my initial report on the Genius Act I was so emphatic and said financial freedom is over; and then weeks later the BIS publishes this paper that expresses how stablecoins and tokens need to be scored to force compliance and modulate behaviors. Unreal!

But, as we understand it, this is the whole point of central banking since its inception; to own it all, to be the buyers and lenders of last resort.

Proverbs 22:7 The rich ruleth over the poor, and the borrower is servant to the lender.

Meanwhile, the Treasury just announced a contract with Palantir to help further build this tokenized system. Palantir, of course, has everyone’s data that they can leverage against us; and thus, that is how this government builds the KYC and AML needed for digital IDs and a tokenized economy.

The BIS also mentions “international cooperation.” I interpret that to mean the International Monetary Fund, the World Bank, the United Nations, and even the BIS itself. The IMF has also spoken a lot about tokenization; and BRICS leaders have called for the IMF to be the center hub of international finance.

Earlier this week, the CEO of Robinhood emphatically said “tokenization will eat the whole global financial system” and will come barreling like a freight train. He’s right.

While we are not there yet, we can clearly see where this is headed.

Revelation 13:16 And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads: [17] And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name. [18] Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is Six hundred threescore and six.

Please help get the word out and share this information to create more awareness. Silence and complacency is what ‘they’ want.

Original Article: Truth Warrior Suggested

Note: Comments placed in [ ] are added by Truth11.com editor. For example; [Flu]

Comments ()