The 50 Year Mortgage | By The Numbers

Dylan Eleven • Truth11.com

Let's take a look at the numbers of the 50 year mortgage that Trump has suggested.

We will find that there is no savings, it will not make homes more affordable, but the interest paid is much much higher. Translation... This is only good for the banks.

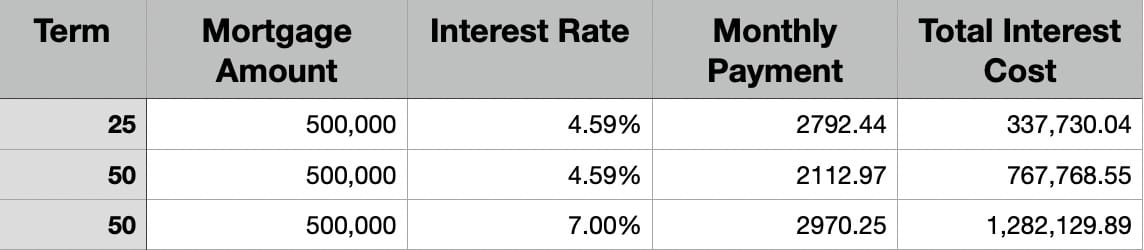

Here is two comparisons between a 25 year mortgage and a 50 year mortgage.

One is at the exact same interest rate, the other which is more probable, is at a higher interest rate for the longer term.

Traditionally a 25 year mortgage was the maximum you would go for. Let's see what happens if you choose a 50 year mortgage instead. This illustration does not include a down payment, insurance or purchase price. For simplicity of math we are just comparing mortgage terms and rates for the same amount borrowed.

At the same interest rate, the monthly payment is lower for a 50 year mortgage than a 25 year one, by $679 per month. Which is a substantial amount. But you have to pay for double the amount of time, and the total interest cost is $460,000 more.

Frequently a longer term mortgage can be at a higher interest rate. If that is the case, the monthly payments would be the same, if not more for a 50 year mortgage over a 25 year one depending on the exact rate, and the total interest paid would obviously be much higher. In our example above using 7% instead of 4.59%, the monthly payments are more on a 50 year vs 25 year and you would pay $944,399 more in total interest.

So how exactly is this a benefit for the people? It is not, it only benefits the banks.

At first these mortgages would be an option, after time they could be the penalty for not having good credit.

Comments ()