The Tokenization of Everything; Including You | The Infrastructure for Biodigital Convergence and the Erosion of Human Sovereignty

Technocracy.news | Patrick Wood

Courtenay Turner | courtenayturner.substack.com

What is Asset Tokenization?

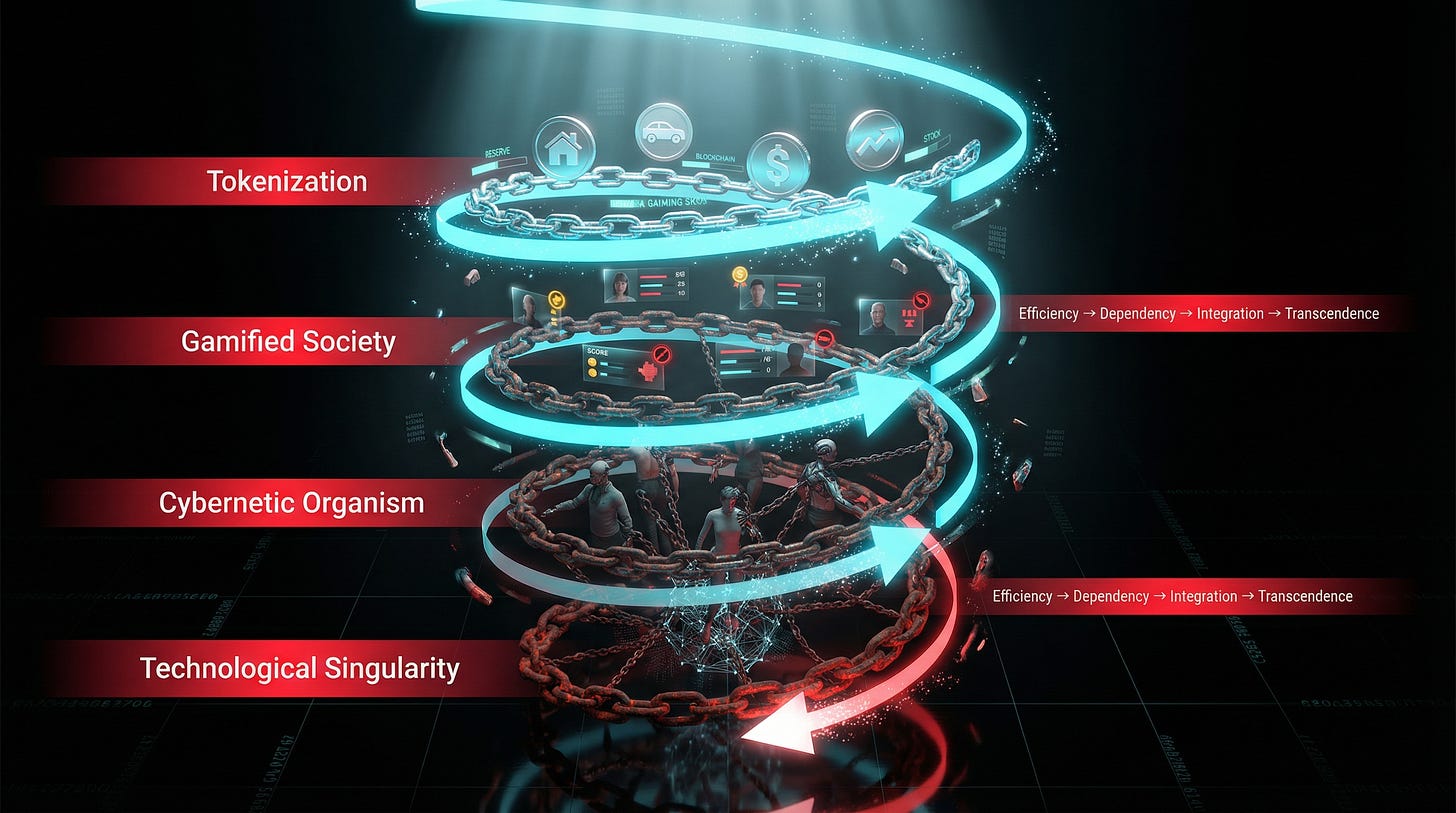

Asset tokenization is the process of converting real-world assets—real estate, stocks, bonds, gold, art, and increasingly biometrics, health data, and even human behavior—into programmable digital tokens on a blockchain. These tokens enable fractionalization, turning indivisible assets into tradable “slices” that can be bought, sold, or restricted instantly, 24/7. What begins as a seemingly efficient upgrade to markets is rapidly evolving into the foundational layer for a system where everything—including your body and mind—can be digitized, tracked, and controlled.

The False Promises of Tokenization

Proponents sell tokenization as revolutionary progress. Larry Fink, CEO of BlackRock, has repeatedly called it “the beginning of the tokenization of all assets,” claiming it will democratize access and make markets more efficient. Institutions celebrate faster settlement, lower costs, and fractional ownership that lets ordinary people “invest” in assets previously out of reach. These promises mask a darker reality: the benefits flow primarily to the issuers and custodians—giants like BlackRock—who retain ultimate control over the underlying assets while the public holds revocable tokens. What is marketed as inclusion is, in practice, a mechanism to pull more of life into a gamified, always-on marketplace where participation becomes mandatory and behavior is subtly—or not so subtly—nudged as part of a cybernetic organism.

Current Ownership vs. the Tokenized Future

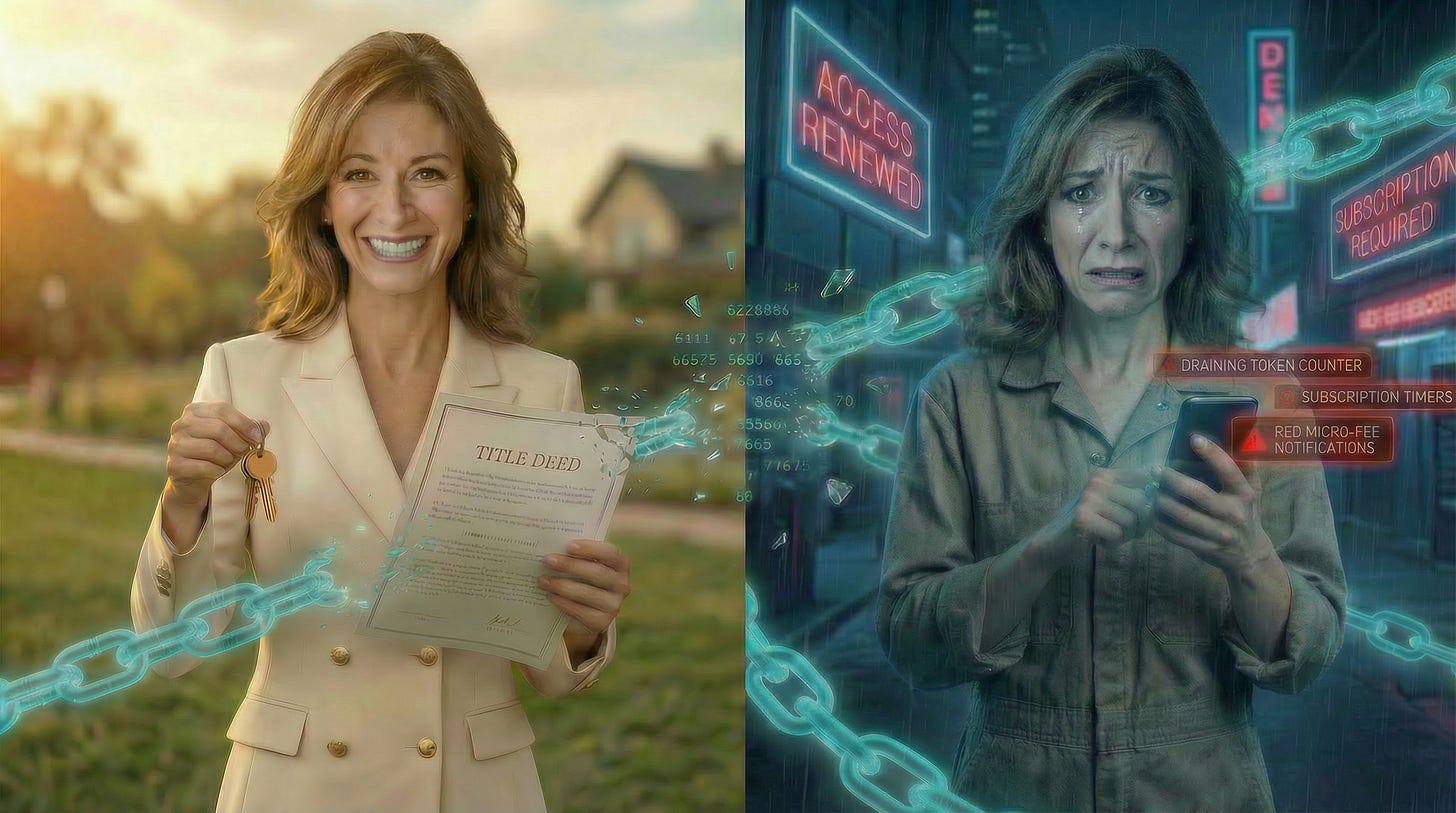

Right now, traditional ownership still offers a measure of tangible sovereignty. You hold the deed to your home (or build equity in it, even under a mortgage), and no one can instantly freeze or trade it away without your consent or due process. One could argue that ongoing property taxes make outright ownership feel like leasing from the government—but that’s a separate debate.

Now imagine the future they’re openly building: Every asset gets tokenized. Your house? Turned into digital tokens. Your car? Tokens. Your savings? Tokens. Even the water you drink (through tokenized rights and utilities), the air you breathe (via carbon credits or emissions tracking), and your biometrics? All tokenized, digitized, and subject to the same programmable ledger.

This isn’t just about finance—it’s the gateway to total intermediation, where the essentials of life become conditional entries in a controlled system.

Regulatory Rails for Total Control: The Mechanics of the GENIUS and CLARITY Acts

The infrastructure is already laid, codified in law. In July 2025, the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) established a federal regime for payment stablecoins, mandating 100% reserves in cash or short-term Treasuries, full KYC/AML compliance, public disclosures, and bank licensing for issuers. It authorizes insured institutions to custody and tokenize deposits and money-market instruments—while the complementary CLARITY Act (Digital Asset Market Clarity Act) delineates qualified issuers, enforces 1:1 backing with audits, and exempts compliant stablecoins from securities rules.

The result? Digital dollars in your wallet will be bank- or state-approved, fully traceable tokens—not free cryptocurrencies. These laws underpin the “tokenization of everything,” enabling on-chain digitization of funds, Treasuries, ETFs, and beyond, all within regulated boundaries prioritizing surveillance over decentralization.

Howard Lutnick, as Commerce Secretary, aligns perfectly: he advocates dollar-backed stablecoins under rigorous oversight, where AI and blockchain “transparency” allow authorities to trace, track, and freeze transactions—just like traditional payments. In hearings and statements, he endorses this as “eliminating crime,” but it builds a programmable, AI-enforced grid.

Larry Fink celebrates it as “the next generation for markets,” with BlackRock’s tokenized funds leading the charge. Yet this system preserves—and amplifies—”safeguards” like KYC gateways, blacklisting, and automated compliance that turn ownership into conditional access.

These acts intersect directly with the World Economic Forum’s “you’ll own nothing and be happy” vision and Klaus Schwab’s Fourth Industrial Revolution: fusing digital, physical, and biological spheres. I'm not sure we'll be so "happy" unless we come to love our servitude in Huxley's Brave New World —Soma anyone? They simplify fractionalization, leasing, and real-time revocation of assets—from homes to devices—mediated by intermediaries who can exclude users via risk scores or rule violations.

Furthermore, they accelerate technocracy: empowering regulators (SEC, CFTC, Fed) and algorithms to dictate standards, enforce freezes, and collect data for predictive control. Decision-making shifts from democratic processes to elites and code, eroding constitutional sovereignty in favor of efficiency and oversight.

Programmable Tokens: From Ownership to Conditional Access

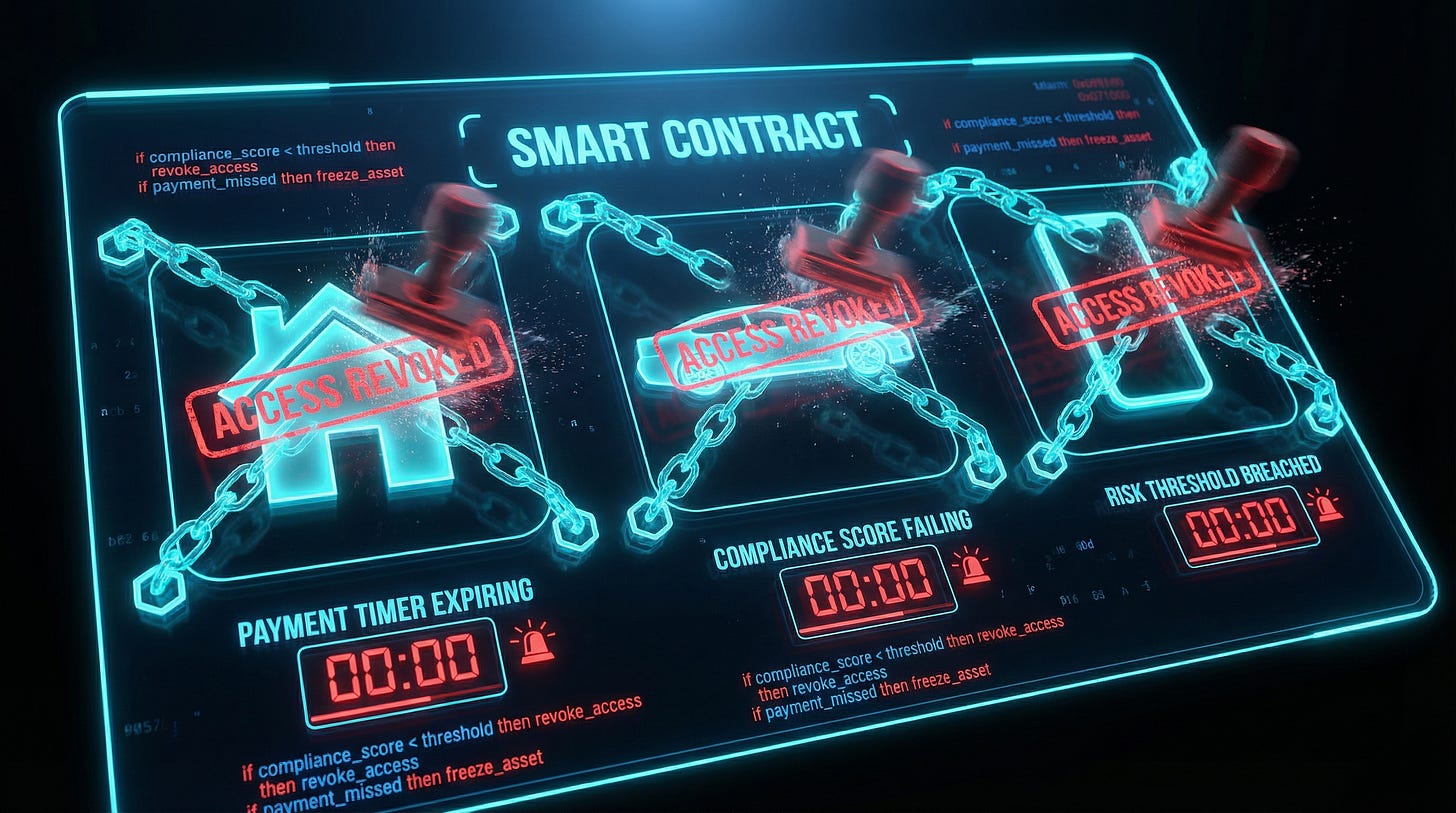

The core danger lies in programmability. Tokens are not neutral representations of property—they are code that can be designed to expire, freeze, or restrict based on compliance scores, social credit–like metrics, or algorithmic rules. Ownership becomes access, revocable at the whim of issuers, platforms, or regulators. Miss a payment? Violate a policy? Fall below a risk threshold? Your tokenized home, vehicle, or even access to services can be locked. This is not speculation—it is the explicit capability of smart contracts in a regulated, bank-integrated ecosystem.

Biodigital Convergence and the Tokenization of the Human

Tokenization is not stopping at financial or material assets. The same infrastructure is extending into the biological realm—biodigital convergence. Biometrics, DNA data, neural patterns, and health metrics are already being digitized and fractionalized in pilot programs and “social impact” finance initiatives. What begins with tokenized carbon credits or ESG scores ends with human behavior itself tokenized—rewarding compliance, punishing dissent, and nudging populations toward predetermined outcomes.

This is the Fourth Industrial Revolution vision articulated by Klaus Schwab: the fusion of physical, digital, and biological spheres. Your body becomes an asset class; your attention, choices, and biology become tradable data streams feeding AI systems that predict and steer behavior. Free will erodes as incentives and restrictions are baked into the tokens that govern access to daily life.

The Subscription Society and the End of Sovereignty

This is the financial and technological substrate for “you will own nothing and be happy”—not as a utopian sharing economy, but as a subscription-based control grid. Durable property rights are replaced by revocable permissions. Institutions trade and profit continuously while individuals rent access to what they once owned outright.

The GENIUS and CLARITY frameworks, far from providing “regulatory clarity” for freedom, are the iron scaffolding for a technocratic system where algorithms and experts—not individuals or democratic processes—hold ultimate authority. Programmable money and assets enable automated enforcement of policy at the protocol level, turning dissent or non-compliance into immediate material consequences.

Conclusion

Tokenization is not merely a new tool for markets—it is the operating system for a post-human paradigm where sovereignty is replaced by managed participation, and free will is subordinated to algorithmic governance. The convergence of blockchain, AI, and biology is not inevitable progress; it is a engineered shift toward total control, sold as convenience and inclusion. If unchecked, it yields digitized feudalism where human agency tokenizes away. Reject the illusion—defend individual sovereignty before permanent encoding into the ledger.

If you’re interested in diving deeper into this material, read chapter 3 of my book co-authored with Patrick Wood.

Source: https://courtenayturner.substack.com/p/the-tokenization-of-everything

Original Article: https://www.technocracy.news/the-tokenization-of-everything-including-you/

Comments ()